In Ireland, sales tax is known as V.A.T.

You'll see this acronym marked on all till receipts when you shop in Ireland.

Now for the good news...

If you're travelling to Ireland from outside the EU, you may be able to reclaim some or all of the VAT you've paid during your vacation.

Read on to understand Irish sales tax and discover how you can enjoy tax-free shopping in Ireland.

What The Dickens Is VAT?

VAT stands for 'Value Added Tax'.

VAT is, essentially, sales tax.

In Ireland, VAT is set at a national level. The standard VAT rate in Ireland is 23%. This covers most goods and services.

If you purchase souvenirs such as clothing or craftwork while in Ireland, you'll pay the standard rate of 23% VAT.

However, VAT is charged at different rates for other goods and services.

VAT Rate For Dining, Hotels & Museums

As our guest in Ireland, you'll no doubt pay VAT on services related to tourism.

VAT is charged at 13.5% for dining in restaurants and cafés, staying in hotels and guesthouses and visiting museums which charge entrance fees.

💡 PRO TIP: You can't reclaim VAT on hotel fees, dining or other services. VAT reclaim is applicable only to goods, not service

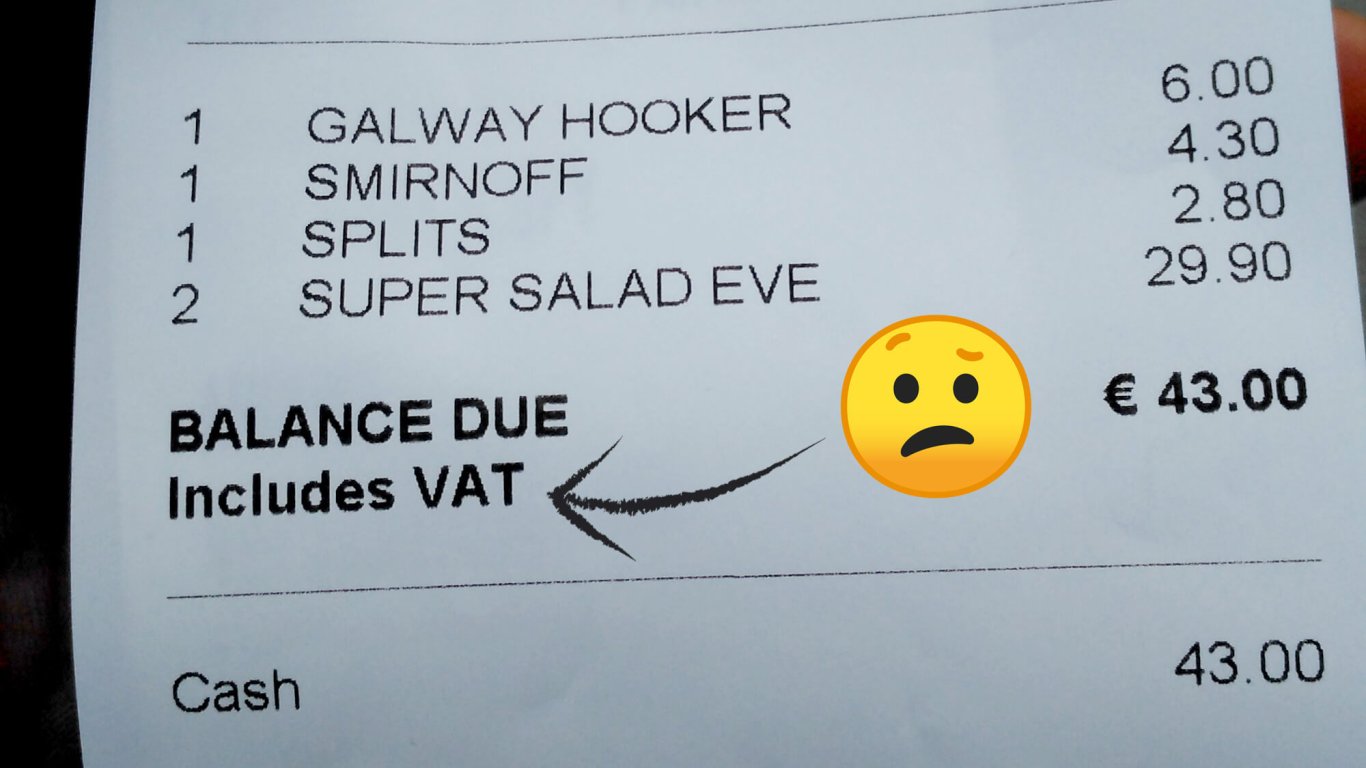

Is VAT Charged Separately?

No. VAT rates are integrated into all prices in Ireland.

Price tags in Ireland will display the same amount as charged at the till and on your receipt.

🤑 Save on VAT

OK, enough about taxes and bills.

Want some good news?

If you're visiting Ireland from the USA, Canada, Australia or elsewhere outside the European Union (EU), you can either avoid paying VAT in the first place or claim your VAT back.

That's up to 23% knocked off the price of most purchases.

Sounds good, doesn't it?

To get tax free shopping in Ireland, take these simple steps...

🧾 Step 1. Request VAT-free purchases at the till

Many retail outlets in Ireland offer VAT-free goods to visitors from outside the EU.

Ask a shop assistant if their outlet provides VAT-free shopping. If they do, you may be asked for proof - your passport and/or confirmation of your flights are typical. VAT-free payments are normally required to be by credit card. This is so there is a record of the purchase and to simplify refunds.

Now, you have 2 options: fill out the export voucher provided by the retailer or ship the goods home then and there (if this option is available - you'll have to cover the shipping costs too).

💡 Remember to ask if there a minimum threshold. Some purchases might be too small to be eligible for a VAT refund.

🛃 Step 2. Visit Customs to Prove You're Leaving Ireland

If you've opted not to ship your goods, you will need to visit the Customs desk in Dublin/Cork/Shannon airports when leaving Ireland.

Have your export vouchers stamped by the Irish Customs officials. Your credit card should then receive your VAT refund from the retailer(s).

💳 Alternative: Pay an agency to reclaim your VAT

An alternative method of reclaiming your VAT is via an agency.

Certain retail outlets in Ireland will offer this method instead of through direct refunds. Global Blue is a common agency offering tax-free shopping at point of sale.

FEXCO offer a card-based method for tax-free shopping in Ireland. You can pre-register your card before arriving in Ireland. After arriving, you use the card as you shop.

The advantage of an agency approach is considerably less paperwork than reclaiming VAT directly. The downside? FEXCO and other agencies take a cut (service fees) so your VAT refund will not be for the full amount you paid out.

Popular retail outlets offering VAT-free shopping via FEXCO Horizon cards include:

Cha-ching!

Now read some of our other blogs about budgeting and spending money in Ireland: